People often get confused about life insurance and death insurance and dismemberment insurance, and when their claim is denied, they don’t know why or what to do next.

Insurance papers can be long, hard to understand, and full of unclear words and forms. Life is full of things we don’t know, and getting ready for the future is a smart step for keeping your money safe.

Two important types of insurance are death insurance and life insurance, and we will talk about the differences in this guide to help you decide what insurance you need.

About Life Insurance

Life insurance is a big money product meant to help your family if you die. There are different types, like term life, whole life, and universal life insurance. Here’s how it works:

Life insurance for a specific time period

This kind gives coverage for a certain amount of a period often 10, 20, or 30 years. If the insured dies within the time, those left behind get a death benefit.

Lifetime Protection

This policy has both lifelong coverage and an element of cash value that grows over time. Whole-life coverage may be utilized as a source of income as well as an investment.

Universal life insurance includes

Global life insurance, which blends coverage for life with an investment component, offers premium payment and death benefit flexibility.

Overview of Death Insurance

Death insurance is sometimes used interchangeably with life insurance. However, it is crucial to understand that death insurance is a subset of the wider concept of life insurance, rather than a different type of insurance.

Diffrences between Life Insurance and Death Insurance

Life Insurance

Life insurance is similar to a savings plan.

It’s an arrangement in which you pay money to an insurance company in exchange for them promising to pay you or your loved ones a quantity of money on a certain date specified in the agreement.”

Money for Family Members

The money donated to your loved ones functions similarly to a special fund.

The money paid to your loved ones is the agreed-upon amount when you signed the contract.

Who Receives the Funds?

The money might go to you or someone you care about.

Taxes

The amount of money you get from a life insurance policy may be taxed differently. It is contingent on how long you hold the contract and when you receive the money.

Death Insurance

Characteristics of the Contract

A sort of insurance contract is a death insurance policy. You pay payments to an insurer, who guarantees that the principal will be paid to your beneficiaries when you die.

Identification of the Beneficiary

The subscriber cannot be the beneficiary. Whether one is a family member or not, the person who benefits is always someone else.

The amount given to the receiver

The premium mentioned in the agreement when it was signed is the amount paid to the recipient.

Taxes

Inheritance taxes

Death capital is exempt from inheritance tax. Contributions paid after the subscriber reaches the age of 70, on the opposite hand, are reinvested into the estate and taxed alongside the remainder of the deceased’s inheritance.

Taxation on earnings

After subtracting €152,500, the beneficiary must pay 20% income tax on the death capital. The taxable amount cannot exceed the subscriber’s most recent annual contribution paid before reaching the age of 70.

While the phrases are commonly used interchangeably, it’s important to understand the subtle differences:

Terminology Focus: “Death insurance” is a less formal word that individuals may use in informal conversation. “Life insurance” is the industry’s official phrase.

Complete Protection: Life insurance consists of numerous plans, each with its own set of benefits. Without identifying the sort of coverage, the word “death insurance” may indicate a broader concept of coverage.

Varieties in Policy: Individuals can pick from a variety of life insurance products based on their specific needs. Understanding the particular sort of life.

Is death and life insurance the same?

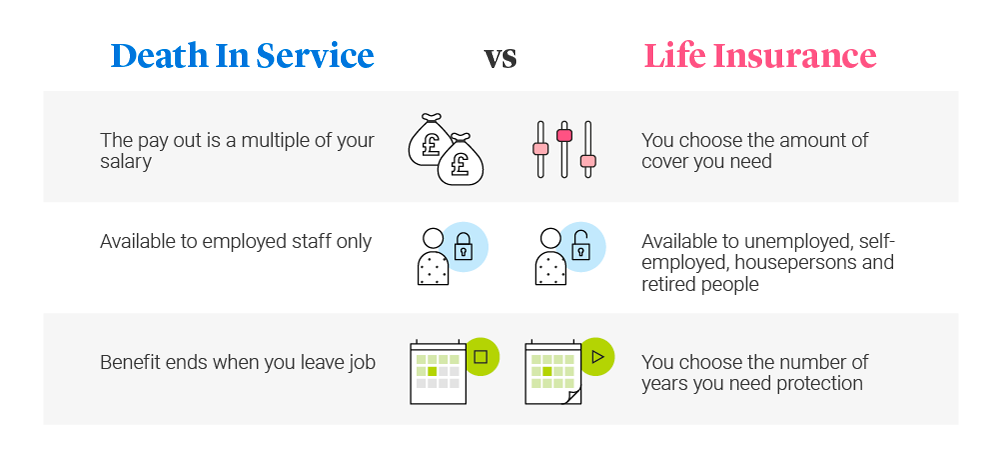

Death insurance cover. Death cover pays a lump sum to your beneficiaries (the people you choose to get your payout) if you die. It’s also known as life cover or life insurance.

Choosing the Most Appropriate Insurance for You

Your financial goals, family situation, and long-term ambitions all affect your choice of life insurance policy. Consider the following factors:

Financial obligations: Consider your financial obligations, such as mortgages, bills, and dependent school tuition.

Goals for the Long Term: Determine if you want coverage for a specific period of time or long-term protection with possible investment benefits.

Considerations for the Budget: The prices of various life insurance policies differ. Determine what is affordable within your financial constraints.

Final Post Wrap

Understanding the differences between death insurance and life insurance is critical in financial planning. Life insurance, with its many plans, provides individuals and families with specialized solutions. Make educated judgments that are in line with your goals as you begin on this adventure’s unique needs, securing a financial future for your loved ones.